Japex cuts its losses and exits Canada shale asset, Japanese company to recognise a large extraordinary loss by Rusell Searancke, May 14, 2021, Upstreamonline

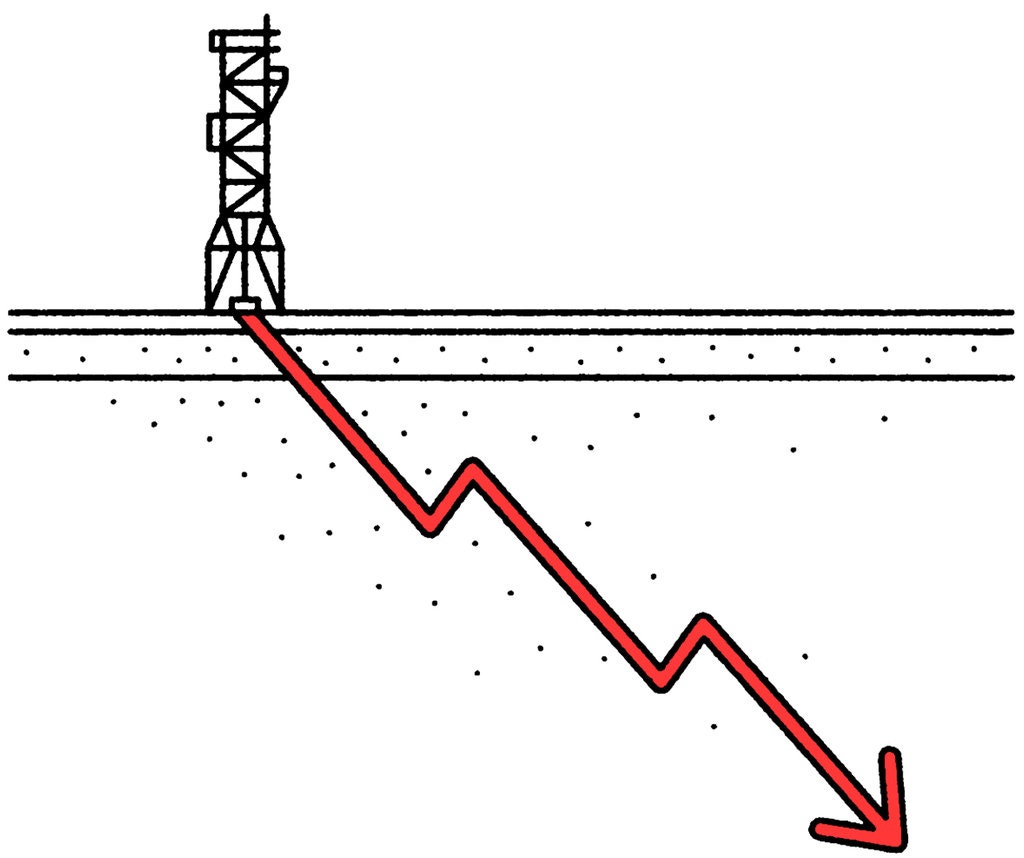

Japan Petroleum Exploration (Japex) has sold to Petronas its interest in a Canadian shale gas asset, and said it will record an extraordinary loss of C$493 million (US$404 million) as a result of the divestment.

Japex said it had resolved to sell its 10% in the North Montney (NM) joint venture, but did not disclose the sale terms.

The asset would have provided the feedstock gas for the cancelled Pacific North West LNG project.

Japex said it had invested in the NM shale gas development and production and pre-development work for the LNG project.

“Even after the decision not to proceed with the LNG project in July 2017 due to changes in the business environment, Japex has been working with PECL (Petronas) and its partners to maximize the value of the NM project by optimizing the development plan,” said the Japanese company.

However, Japex decided to sell its interest because “the environment surrounding the E&P business is expected to become even more severe due to the prolonging effects of the Covid-19 since early last year, including the structural changes by the new normal after the Covid-19 and accelerating the global decarbonization.”

As a result of the transaction, Japex said it expects to record an extraordinary loss of C$493 million in the consolidated financial results for the second quarter of the year ending 31 March 2022.

The co-owners of the NM asset are Petronas (62%), Sinopec (15%), Japex (10%), India Oil (10%) and Petroleum Brunei (3%).

Refer also to:

… Since 2012, 77 per cent of the earthquakes triggered by fracking in the Montney have been caused by three companies: Petronas, Tourmaline Oil and Ovintiv (formerly Encana).

Petronas, a Malaysian company, holds the record for most quakes. Its fracking activities are associated with 78 per cent of the earthquakes in the northern Montney and almost one-half the earthquakes in the entire Montney over the 2013 to 2019 period.

… Petronas led with the highest earthquake rate: “39 per cent of its fracked wells are associated with earthquakes,” followed by Tourmaline Oil with 29 per cent and Ovintiv at nine per cent.

… Drilling by Petronas in 2015 provides an example of the importance of cumulative impacts in Chapman’s study.

In August of that year, the company’s fracking generated a magnitude 4.6 earthquake in the north Montney. “For this event, Petronas was the sole operator, injecting 67,625 cubic metres of frack fluid into three wells in the week before the earthquake,” noted the science paper. But over a two-year period prior to the event, Petronas had injected a total of 275,000 cubic metres of frack fluid into the ground.

… Chapman concludes that a total of 439 earthquakes recorded by Natural Resources Canada in the Montney region between 2013 and 2019, had a “close association” with fracking and that the overwhelming majority of them—77 per cent—were linked to the fracking operations of just three companies led by Petronas with 209 associated earthquakes, Tourmaline Oil with 79 and Ovintiv (formerly Encana) with 38.

Petronas, which is a significant partner in the proposed Canada LNG facility, has such a high number of earthquakes associated with its operations partly because it operates in the northern portion of the Montney, which is geologically distinct from the more southern portion of the basin and treated as such by the Commission. Petronas is also the largest subsurface rights holder in the province and holds a monopoly position in the North Montney, Chapman found. …