“As a shale producer, you’re constantly fighting this enormous decline rate.”

![]() Fracing was never a revolution, it’s always been a con. Frac’ers and their enablers planned on making taxpayers and the harmed pay for clean up. And now it’s a bankruptcy con being used to further enrich the super rich, enabled by our courts (which are also taxpayer funded). The job numbers were never what industry or main media proclaimed.

Fracing was never a revolution, it’s always been a con. Frac’ers and their enablers planned on making taxpayers and the harmed pay for clean up. And now it’s a bankruptcy con being used to further enrich the super rich, enabled by our courts (which are also taxpayer funded). The job numbers were never what industry or main media proclaimed.

I remain stunned at how many people fell for the con and are still falling for it. Investors will likely lose billions more.

Lots of errors (or lies) in Bloomberg’s clip. For accurate science and history on frac’ing, read Andrew Nikiforuk’s Slick Water.

Frac’ing is not just done on deep horizontal deep wells. Environmental NGOs like to pimp this lie too.

Frac’ing is also done vertically and on shallow wells and directly into community drinking water aquifers as Encana/Ovintiv did in Pavillion Wyoming and Rosebud Alberta.

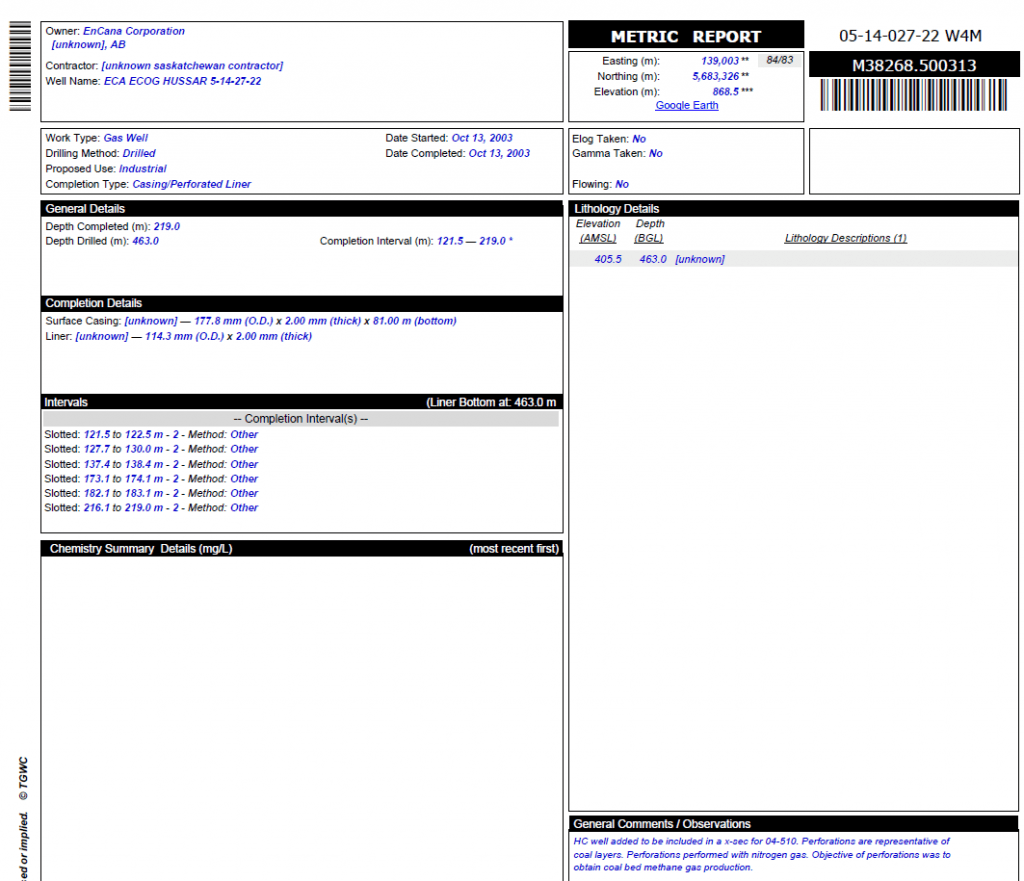

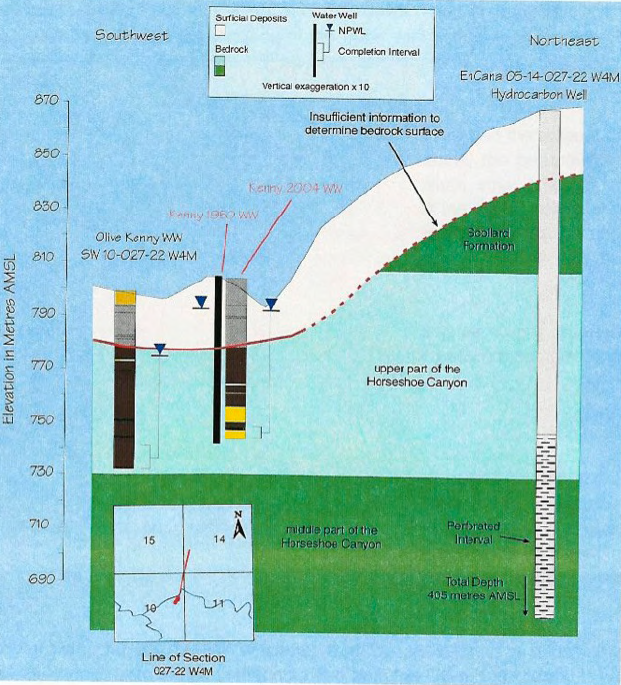

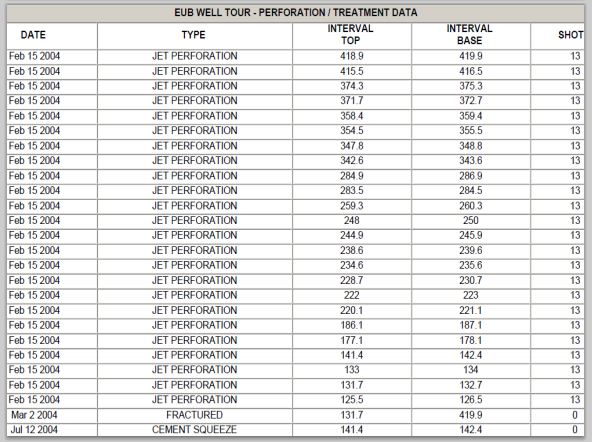

Above: Encana/Ovintiv data on file with the water regulator, proving the company planned to break the law, and frac a community’s drinking water aquifers

Most of the shallow frac’d wells in Alberta and Saskatchewan are vertical with no horizontal leg and a lot of fracs and refracs

Encana/Ovintiv’s data on file with the regulator. Depths in metres (my community’s water wells are in the valley bottom, Encana’s fracs are up on top putting the fracs directly into our water supply aquifers)

In California, regulators allow frac waste injected into protected aquifers.

Why is Bloomberg glorifying McClenndon? It’s been long reported he was a ruthless crook from the start.![]()

Fracking: From Revolution to Money Pit 16:44 Min. by Bloomberg, July 2nd, 2020

For most any nation, let alone a superpower, energy independence is considered the geopolitical holy grail. So when fracking lured in American investors, everyone had high hopes the country would finally break free of OPEC. But oil is a complex game…. What’s worse, the startup mentality of the U.S. fracking industry promised investors mythical growth and nonexistent returns. In the end, it burned a $340 billion hole in Wall Street’s pocket.

… “It’s an illusion. They set them up like joint ventures, but the investors don’t have any real power,” he said. “What the investor doesn’t know is the promoter is getting most of the money. There’s little incentive to find good prospects because the promoter is getting paid whether the well hits or not.” …

As the losses piled up, there was always the promise from Boteler that the next well was the one, Rice said. “You know what? The whole thing is greed,” he said. “You get so far in, you get in trouble. I never put myself in a hole I couldn’t survive. But I didn’t do the due diligence I should have.

If you’re not a crook yourself, it’s very hard to figure out how somebody would lie like that.” …

As investors watched their money disappear, Boteler pocketed $1.3 million in salary, bonuses and expenses, including $65,000 to pay his children’s private school fees.

Image by Will Koop, BC Tap Water Alliance