“That was when I ruled the world”

Shale’s Bust Shows Basis of Boom: Debt, Debt and Debt by David Wethe and Kevin Crowley, Bloomberg, July 23, 2020, Washington Post

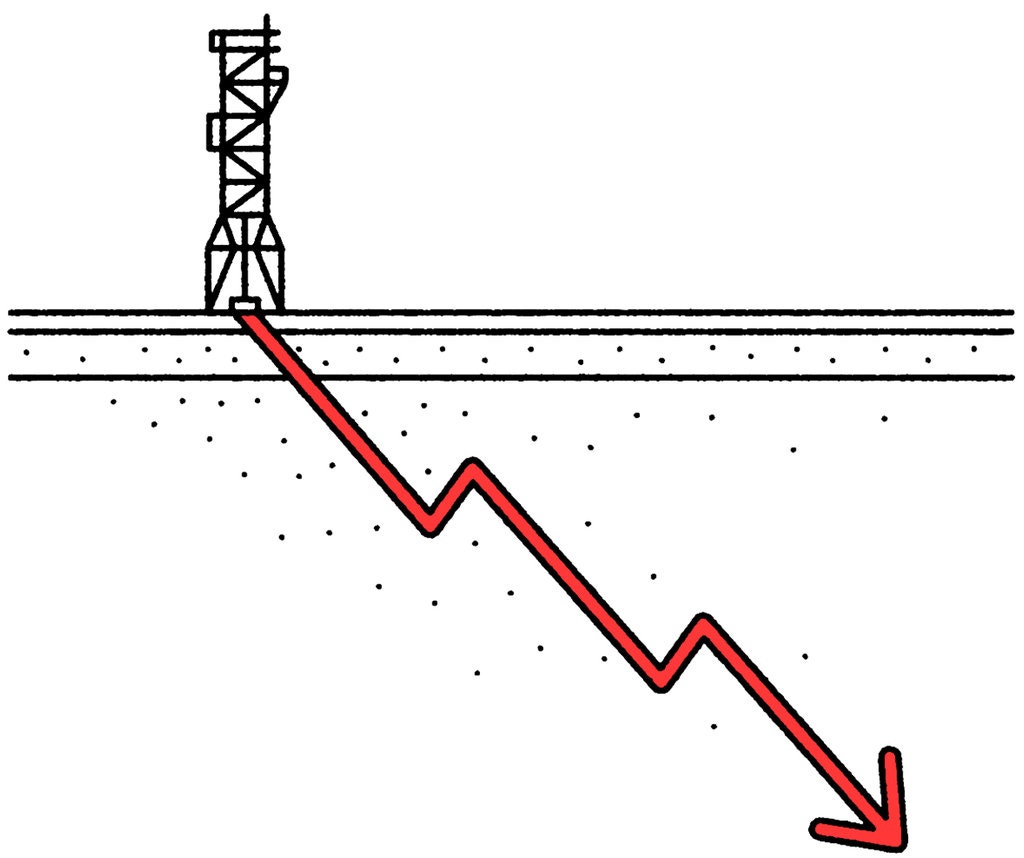

America’s shale boom once looked like one of the century’s great business success stories. Now some of its most iconic names are in bankruptcy court and we’re not done yet. ….the sector’s weaknesses extend back many years, as U.S. oil and gas companies ran up over $300 billion in losses since 2010. Here’s a look at what went wrong and what the fallout might be.

- How bad is it?

More than 230 North American oil and gas producers, owing at least $152 billion in debt, have filed for bankruptcy since the beginning of 2015, according to the latest report from law firm Haynes & Boone. In the second quarter alone, companies that went bankrupt had total debts of $29 billion. The restructurings are showing no signs of letting up, as June tied for the busiest month on record with seven oil and gas bankruptcies, according to data compiled by Bloomberg. That month, the shale bust marked a grim milestone by claiming the pioneer of America’s drilling ![]() con

con![]()

renaissance, Chesapeake Energy Corp. For other parts of the shale supply chain, 2020 is also on pace to be the biggest year of bankruptcies in terms of debt owed.

- What happened?

….a crackdown by creditors alarmed at the industry’s debt levels had begun last year. Even before the pandemic, investors were demanding like never before that companies spend no more than they earn. That led to explorers slashing spending so fast in late 2019 that it forced an unprecedented, market-wide scrapping of idled fracking equipment throughout North America. Halliburton Co., the world’s biggest provider of fracking services, wrote down the value of its fracking gear and other assets to the tune of $1.1 billion for the first three months of this year and another $2.1 billion for the second quarter. That followed similar moves by larger rivals Schlumberger Ltd., which recorded an $8.5 billion pretax, first-quarter charge, and Baker Hughes Co., which wrote down $15 billion in value from two of its biggest businesses.

- What about this year?

… Even when oil is at $35 a barrel, almost a third of U.S. shale producers are technically insolvent, according to a recent study by Deloitte LLP. Technical insolvency means a company’s discounted future value at a certain oil price is lower than its liabilities, though whether it actually files for Chapter 11 bankruptcy depends on other factors, including whether lenders will extend additional credit.

- What’s the impact of the lower prices?

Tumbling crude prices have a first and immediate effect: Lost revenue for oil services companies such as Baker Hughes and Halliburton as spending on drilling and fracking new wells is quickly cut off. The explorers who hire them are somewhat better protected because they’re able to buy insurance, known as hedges, on falling oil prices. But hedges ultimately run out.

Source: Here’s David Einhorn’s presentation on one energy company that he thinks can survive the industry rout that lost 77% of its value back in 2015

And that leads to another effect: the shale producers may be forced to write down their own assets by $300 billion this year, to reflect assets that are worth less as oil prices stay low, Deloitte said. While the writedowns are non-cash items, they reduce the value of an explorer’s equity and increase its debt-to-equity ratios, a key measure of indebtedness used by lenders. The shale industry’s leverage ratio would increase to 54% from 40% with the writedowns, according to Deloitte.

That could lead to more companies getting cut off by lenders.

- What made shale so vulnerable?

Shale producers’ financial problems stem from a decade’s worth of huge production growth using new fracking technologies funded by massive borrowing and financing from Wall Street.

Producers wooed investors by touting rosy estimates of how much crude oil they could profitably drill. But those estimates have proved too optimistic.

One company, SandRidge Energy Inc., lowered its reserve estimates in eight of the last 10 years, according to data compiled by IHS Markit, even as the average oil price rose in four of those years, as extraction proved more difficult than originally thought. After years of meager returns, investors began demanding that shale companies stop marketing future barrels that would never earn a dollar. That led massive cutbacks in oilfield spending, which hurt the service companies, who had already seen their margins shrink after years of price cuts to win market share in a highly competitive field.

- How much money has been lost?

The production boom propelled the U.S. to become the world’s largest producer of both oil and gas. But in doing so, explorers burned through some $342 billion of cash since 2010, leaving little in the way of returns for investors. The biggest oilfield service and equipment companies invested roughly $85 billion in their businesses over the past decade, only to see their earnings fall by $4.7 billion and net debt climb by $19 billion in that same period, according to an Evercore study in February.

- What’s that meant?

As soon as oil prices began tumbling in March, shale producers rapidly slashed everything from drill rigs to workers. Roughly 1.75 million barrels a day of production was shut in as producers couldn’t find buyers. As the oil industry continues to shrink activity this year, the shale patch is expected to see the biggest cut in spending anywhere in the world, according to industry consultant Rystad Energy. Onshore North American fields are expected to see investments slashed by more than half to $67 billion.

- Who’s getting hurt?

Explorers are getting a small reprieve from, as oil prices doubled to about $40 a barrel since the start of May. But that may not be enough. While costs for the best parts of the world’s biggest shale patch, the Permian Basin of West Texas and New Mexico, break even below this level, the bulk of U.S. shale does not. In any case, most shale producers are busy conserving cash to repay their debts. But it may be the shale service companies that take the biggest hit through all this. They’re generally the first to see the cutbacks when a downturn begins and the last to feel the boom. And they’re much more manpower and equipment intensive compared to their customers who own the wells, so their workers are taking the brunt of the shift.

- How many jobs are involved?

More than 100,000 U.S. oil jobs have been lost since the virus-induced downturn began earlier this year, according to Rystad, with the biggest chunk coming from the oilfield servicers. But the job cuts of late have spanned all corners of the oil patch, from engineers at exploration companies including Exxon Mobil Corp. to portfolio managers at private equity firms as the value of their investments shrink.

- Who’s holding up?

Ultimately the biggest companies with the best balance sheets and broadest portfolios have a better chance for survival, while reductions in domestic output will fall on the smallest producers that can least afford it because of their unwieldy debt loads. The result is likely to be a sector increasingly dominated by international behemoths that have the ability to endure the downturn and ramp back up once prices recover. ![]() And abuse the environment and frac’d families and communities more than ever with “regulators” always looking the other way. Thankfully, PA has AG Josh Shapiro. Canada has nothing but empty pea pod Encana/Ovintiv frac crime enablers like Bev Yee and Martin Foy on the board of the AER, and Peter Watson chairing the national regulator.

And abuse the environment and frac’d families and communities more than ever with “regulators” always looking the other way. Thankfully, PA has AG Josh Shapiro. Canada has nothing but empty pea pod Encana/Ovintiv frac crime enablers like Bev Yee and Martin Foy on the board of the AER, and Peter Watson chairing the national regulator.![]()

- What does this mean for credit markets?

All of this has ultimately led to credit markets to essentially close their doors to the U.S. oil industry. Banks leery of keeping explorers afloat have tightened their protections on credit facilities, including lower leverage thresholds, anti-cash hoarding restrictions, reduced dividend caps, limits to the amount of unsecured debt that can be repurchased and higher interest rates, according to a report last month from S&P Global Ratings.

The amount of distressed oil and gas debt trading was $78.7 billion as of July 10, a 10% increase compared to early March, according to data compiled by Bloomberg. And the situation is poised to get worse before it gets better, as the amount of debt at risk could expand by almost a third within weeks as companies skip payments. The energy industry is on pace to surpass 2016 as its busiest year of bankruptcies since oil prices first cratered from more than $100 a barrel in 2014.

Refer also to: